React Native for FinTech: The Ultimate Guide to Building Powerful Finance Apps in 2025

Thinking of building a FinTech app? Discover why React Native is the go-to framework for startups and giants alike. Learn about its benefits, real-world use cases, best practices, and more. Ready to build? Learn Full Stack Development at CoderCrafter.in!

Let's be real. Our phones have become our wallets, our banks, and our financial advisors. From splitting the bill with friends to investing in crypto, we want it all, and we want it now, without switching between a clunky mobile website and a slow, native app.

This is the world of FinTech. And if you're a business looking to build an app in this space, you're faced with a million-dollar question: How do we build a fast, secure, and feature-rich app for both iOS and Android without blowing our entire budget?

The answer, more often than not, is React Native.

But wait. "A cross-platform framework for something as sensitive as my money? Is that even safe?" I hear you. That’s the exact doubt we're going to smash to pieces today.

First Off, What Even is React Native?

In simple terms, React Native is like a superhero version of web development. It lets developers use JavaScript and React (a super popular web library) to build apps that look and feel truly native on both iOS and Android.

Think of it like this: Instead of building two separate houses (one for iOS, one for Android) with different sets of bricks and architects, you're building one blueprint that can be used to construct nearly identical houses on two different plots of land. You save a ton on time, cost, and labor, and the end result is a solid, beautiful home on both sides.

Why is React Native Absolutely Killing It in FinTech?

The FinTech industry is brutal. It's fast-paced, highly competitive, and demands perfection. Here’s why React Native fits right in:

1. Speed-to-Market is EVERYTHING

In FinTech, if you're late, you're dead. React Native’s "Learn Once, Write Anywhere" philosophy means your development team can build for both platforms simultaneously. You're not waiting for an iOS team to finish before the Android team can start. This can literally cut your development time in half, allowing you to launch, get user feedback, and iterate faster than your competitors.

2. Cost-Effectiveness Without Compromise

Hiring two separate teams of iOS (Swift) and Android (Kotlin) developers is expensive. Maintaining two separate codebases is a nightmare and doubles the cost. React Native consolidates this into one team and one codebase, leading to massive savings in both development and maintenance. For startups and even established companies, this is a game-changer.

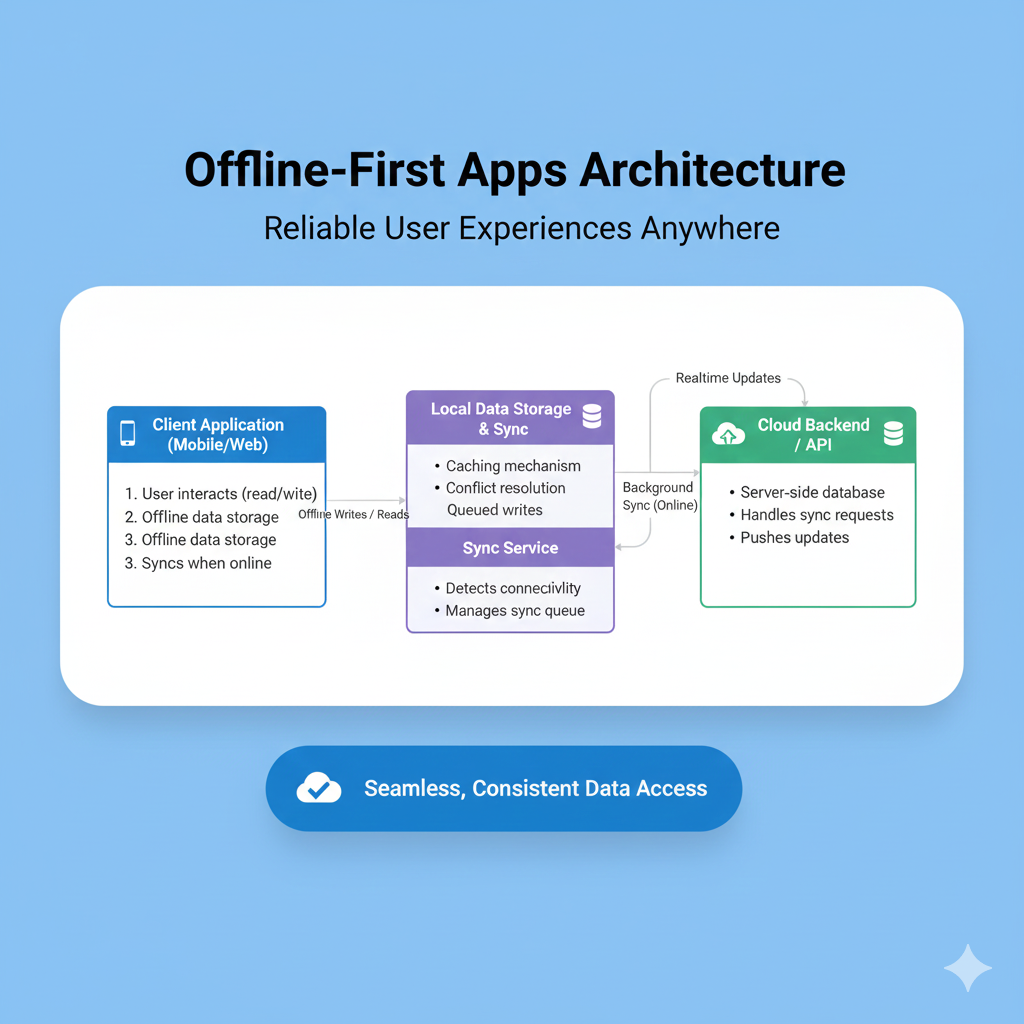

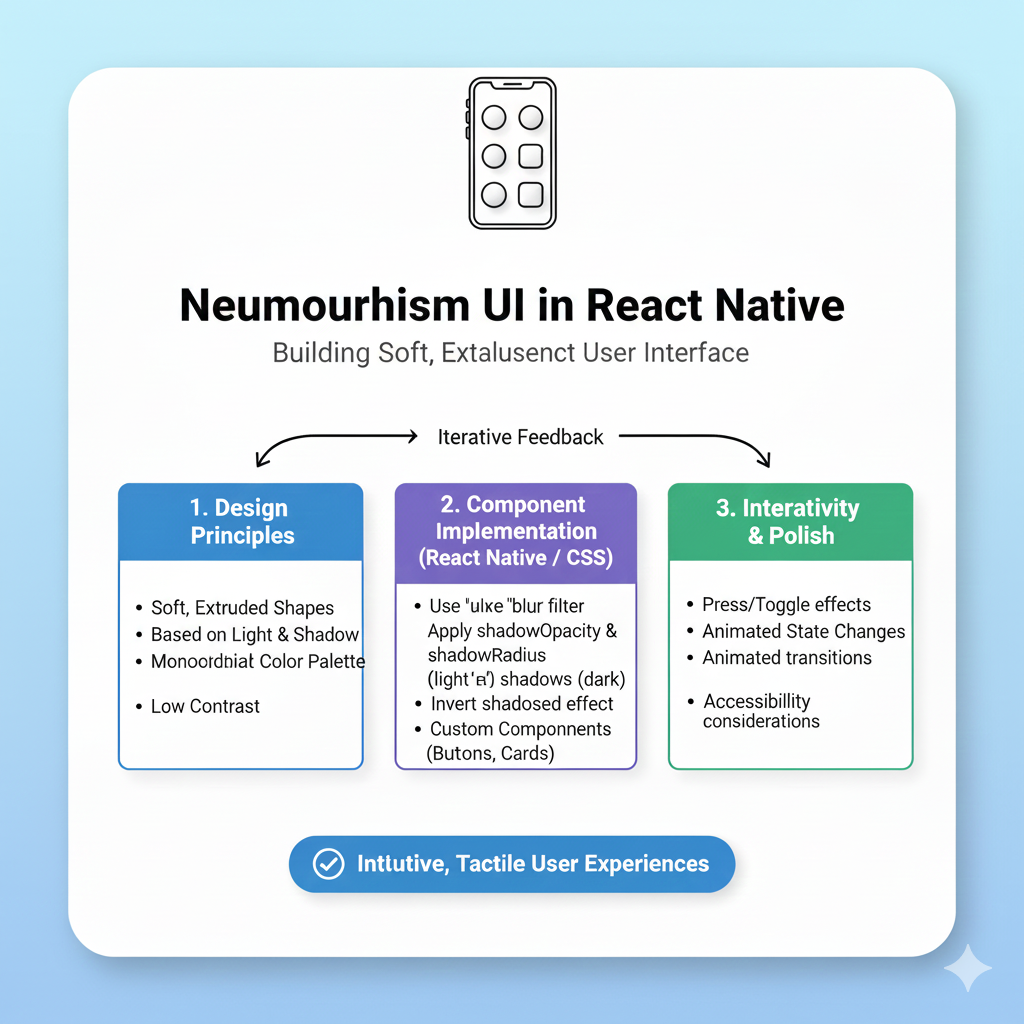

3. A Truly Native User Experience

Forget the clunky, slow hybrid apps of the past. React Native uses native components under the hood. This means your app will use the same building blocks as an app built purely in Swift or Kotlin. The scrolling, the animations, the gestures—it all feels buttery smooth and platform-appropriate. In a FinTech app, where user trust is built on a seamless experience, this is non-negotiable.

4. The Power of a Live "Hot Reload"

This is a developer's dream. "Hot reloading" lets developers see the changes they make to the code in real-time, without recompiling the entire app. This makes the development and debugging process incredibly fast. Want to tweak the color of a "Pay Now" button? It's visible in milliseconds. This agility is crucial for quickly fixing bugs and A/B testing new features.

5. A MASSIVE Ecosystem and Community

React Native is backed by Meta (formerly Facebook) and has a colossal community of developers. This means:

Pre-built Solutions: A vast library of open-source libraries and packages for almost any feature you can imagine—charts, biometric authentication, secure storage, etc.

Easy Hiring: Finding skilled React Native developers is easier than finding niche native developers.

Constant Innovation: The framework is constantly evolving with community-driven improvements.

Real-World Giants Using React Native in FinTech

Don't just take our word for it. Some of the biggest names in finance trust React Native with their multi-million dollar apps.

PayPal: One of the earliest and most prominent adopters. They rebuilt key parts of their app in React Native to unify their development process and accelerate feature rollout.

Coinbase: The massive cryptocurrency exchange uses React Native to power its main consumer app, providing a smooth and consistent trading experience for millions of users across the globe.

Bloomberg: The financial data and media giant uses React Native to deliver a highly interactive, personalized content experience for its users on both mobile platforms.

Wise (formerly TransferWise): Known for its seamless international money transfers, Wise utilizes React Native to maintain a consistent and efficient user interface.

Best Practices for Building Rock-Solid FinTech Apps with React Native

You can't just wing it with FinTech. Security and performance are paramount. Here’s how to do it right:

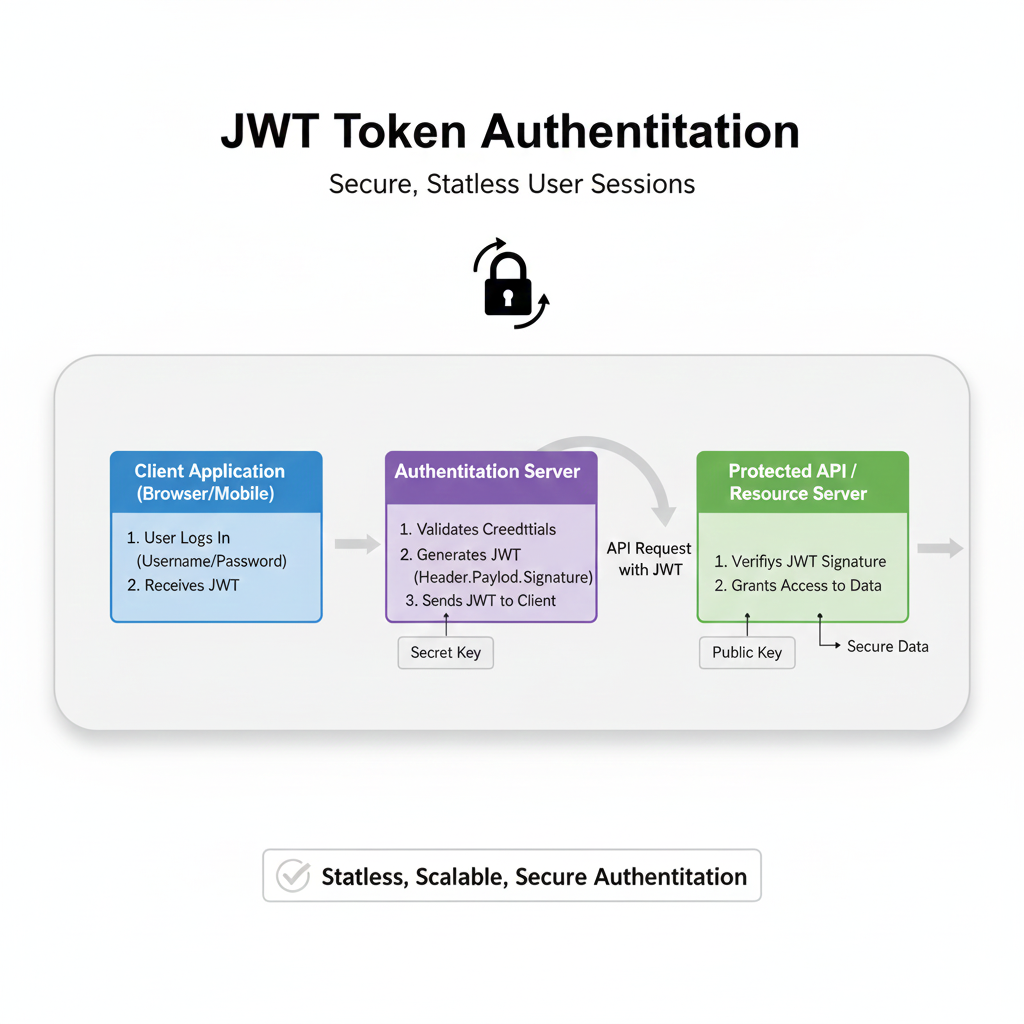

Security First, Always:

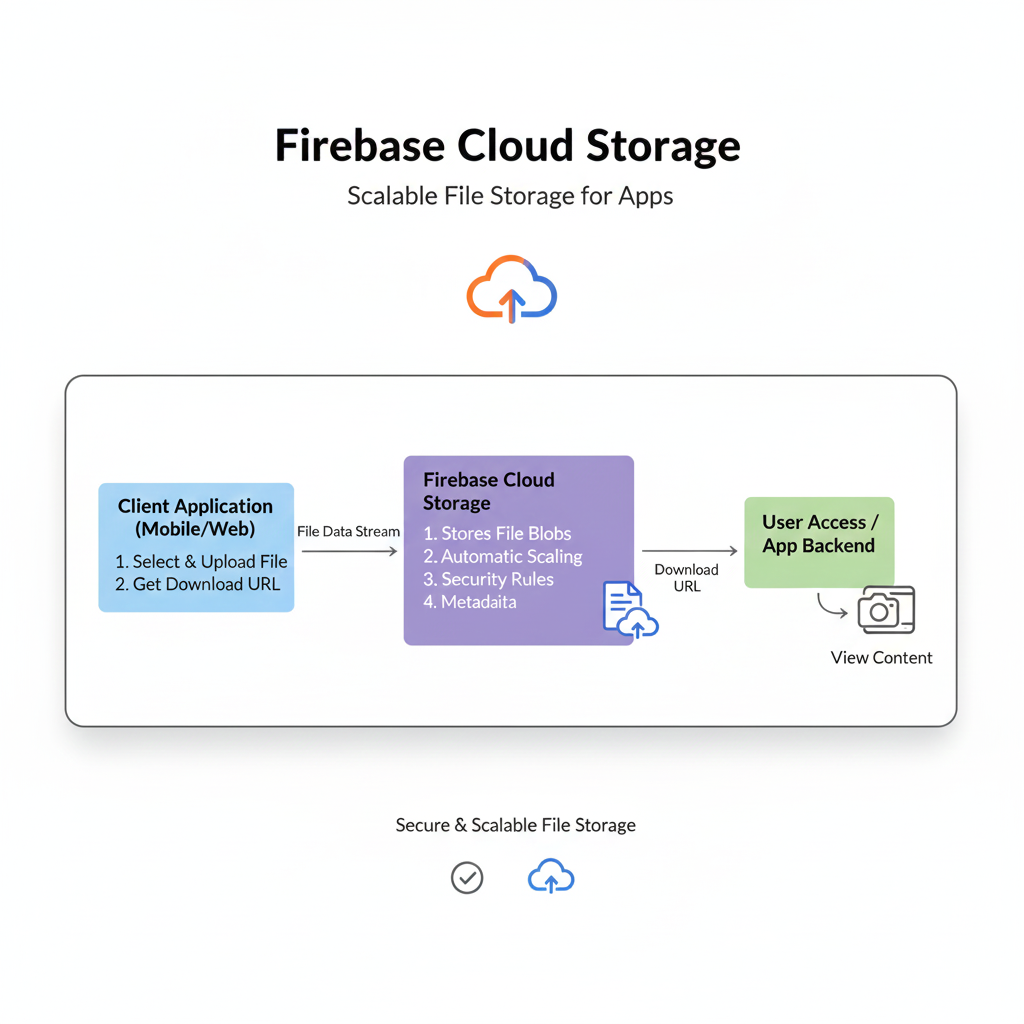

Secure Storage: Never store sensitive data like auth tokens or PINs in AsyncStorage. Use dedicated, secure storage solutions like

react-native-keychain(for iOS) andreact-native-sensitive-info(for Android).Code Obfuscation: Make your compiled code hard to reverse-engineer using tools like ProGuard for Android and manual obfuscation for iOS.

SSL Pinning: Prevent man-in-the-middle attacks by pinning your app to your server's certificate. This ensures the app only communicates with your legitimate server.

Optimize Performance Relentlessly:

Minimize Bridge Calls: Too much communication between JavaScript and the native thread can cause lag. Use tools like

Hermes(a JS engine built for React Native) to improve startup time and reduce memory usage.Optimize Images and Bundles: Use compressed images and consider code-splitting to keep your app bundle lean and mean.

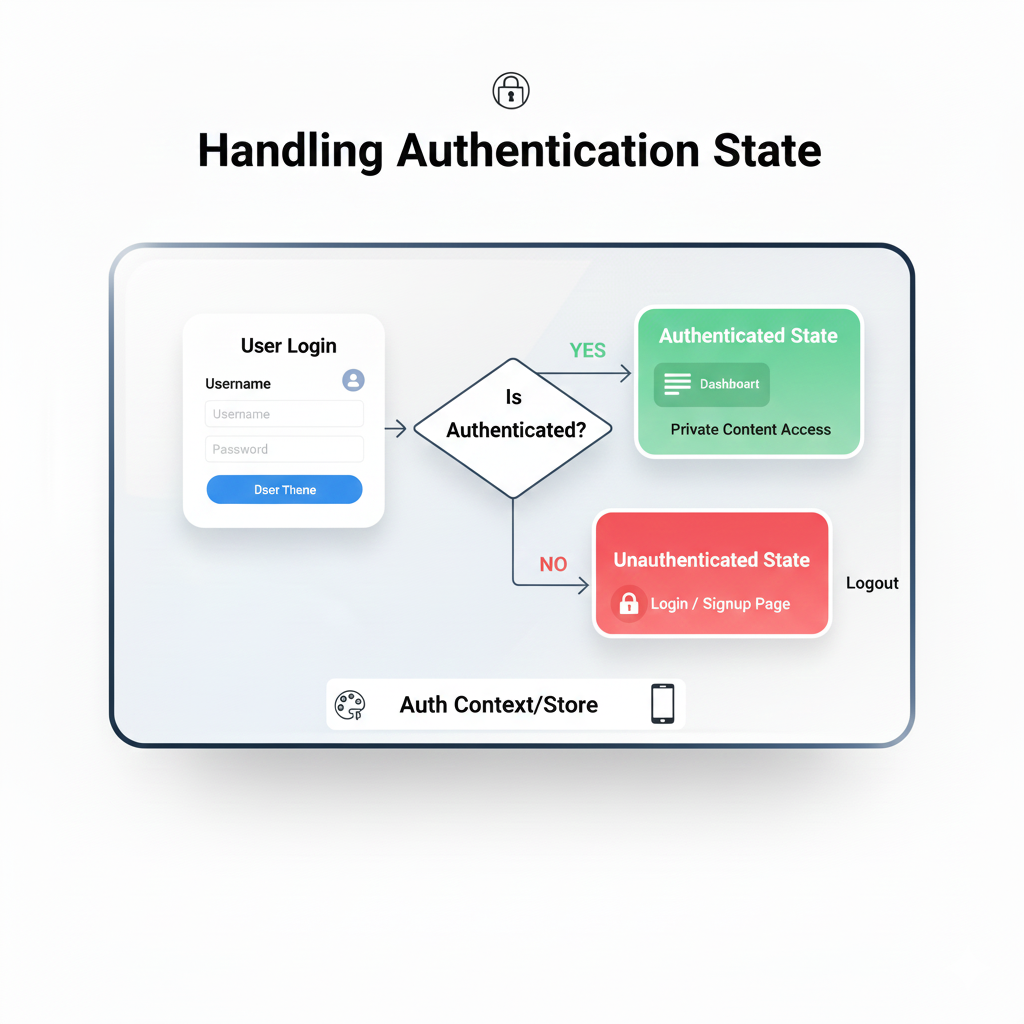

Maintain a Clean and Scalable Codebase:

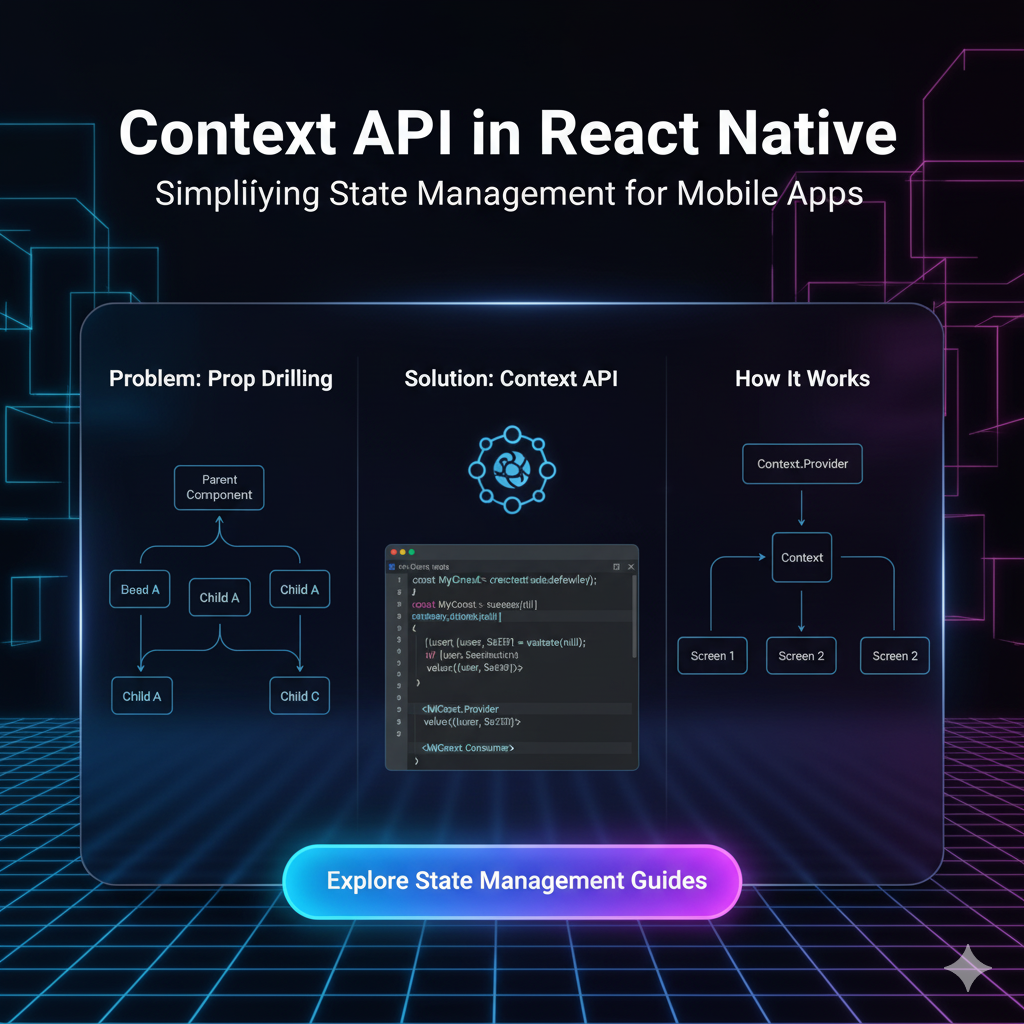

Use a state management library like Redux Toolkit or Zustand to handle complex application state (like user balances, transaction history, etc.) predictably.

Implement a structured navigation system using React Navigation to ensure a smooth user flow.

Prioritize Accessibility:

Your financial app should be usable by everyone. Use accessibility props (

accessibilityLabel,accessibilityHint) to make your app work seamlessly with screen readers.

FAQs: Your Burning Questions, Answered

Q: Is React Native really secure enough for banking apps?

A: Yes, absolutely. The security of an app depends more on how it's built than the framework itself. By following strict security protocols (secure storage, SSL pinning, etc.), a React Native app can be as secure as any native app. The framework provides the tools; it's up to the developers to use them correctly.

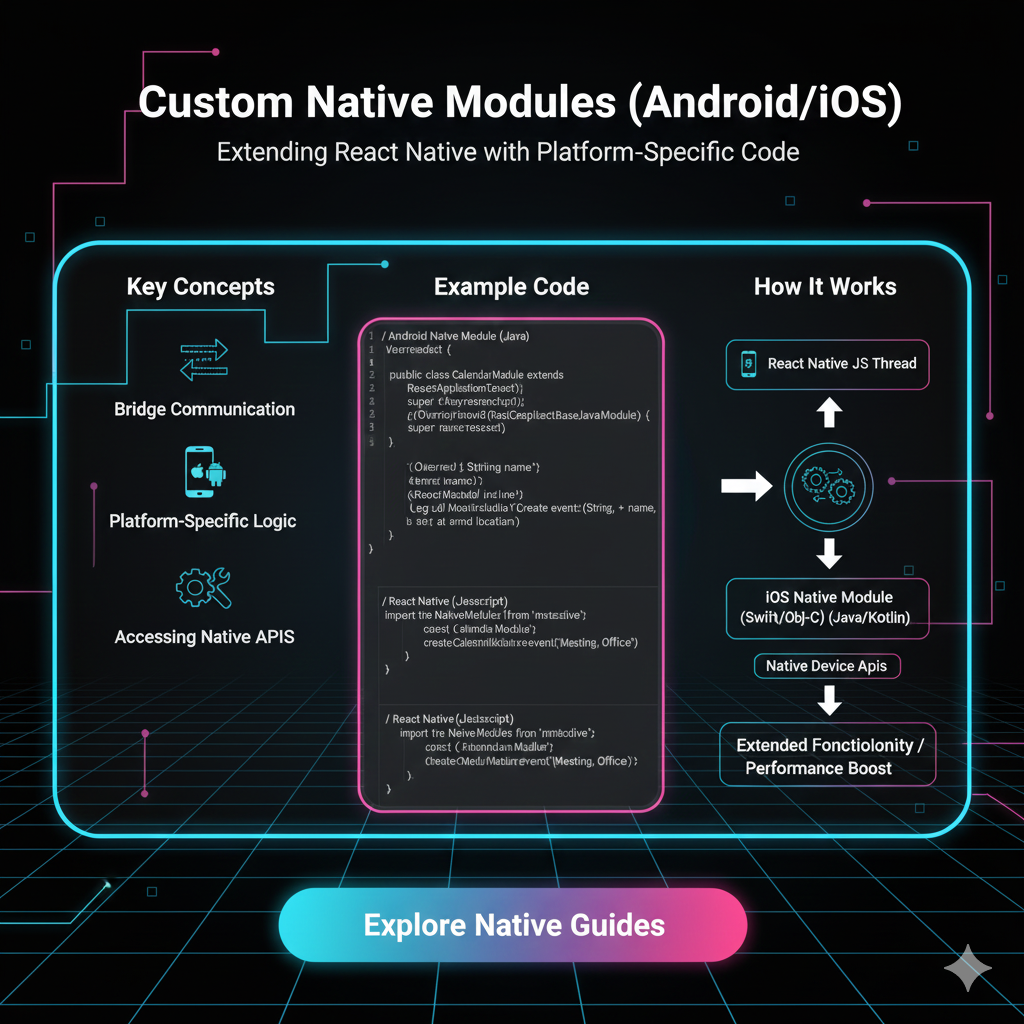

Q: What about complex features like check deposit via camera?

A: This is where React Native shines. For highly specific native functionalities not available out-of-the-box, you can create your own Native Modules. This allows you to write native Swift/Kotlin code for the camera processing and expose it to your JavaScript code. You get the power of native with the convenience of React Native.

Q: How is the performance compared to fully native apps?

A: For the vast majority of FinTech use cases (dashboards, transaction lists, forms, etc.), the performance is indistinguishable from native. For graphics-intensive tasks like complex chart animations, you might need to optimize or write a native module, but this is the exception, not the rule.

Q: Will my app get rejected by the Apple App Store?

A: No. Apps built with React Native are fully compliant with App Store and Play Store guidelines. Bloomberg, PayPal, and Coinbase are all in the App Store, aren't they?

Conclusion: The Future is Cross-Platform

React Native is not just a trend; it's a strategic choice for building scalable, high-performance, and cost-effective FinTech applications. It empowers businesses to deliver a premium user experience without the premium cost and development time of maintaining two separate native apps.

The proof is in the pudding—or in this case, in the apps of some of the most successful financial companies in the world. By leveraging its strengths and adhering to strict security and performance best practices, you can build a FinTech app that users not only love but also trust with their financial data.

The world of finance is moving at lightning speed. To keep up, you need the right technology and the right skills.

Speaking of the right skills, the principles behind building such powerful applications are rooted in a strong understanding of modern software development. If you're inspired to start building the next PayPal or Coinbase, you need to start with the fundamentals. To learn professional software development courses such as Python Programming, Full Stack Development, and the MERN Stack, visit and enroll today at codercrafter.in. We'll give you the tools to not just follow trends, but to set them.